AK Steel's Opportunities & Woes; Which Will Prevail? - Jon Stehlik

Introduction:

AK Steel has been taking a beating for the past several years, as have most American steel companies. However, AK Steel (AKS) has recently swung to profitability after many years of no profits, thanks in part due to the Trump Administration's tariffs on steel and many other items, on national security terms. AKS is expected to continue benefiting from these tariffs, as long as they are in place. With AKS's recent initiatives to reduce debt and acquire valuable entities to add to its arsenal of innovative products, the future looks somewhat brighter. However, there certainly are concerns of the tariffs being only a temporary boost for American steel companies, fading off as they are rolled back with no meaningful measures to shield the U.S. industry from cheap imports.

AKS is a leading steel producer in the U.S. and is the only company in North America that can produce all three major types of flat rolled steels; carbon, stainless, and electrical. The company serves three primary markets; automotive, infrastructure and manufacturing, and distributing and converters, with the automotive market having the largest weight of all three, at 65% of total sales. The company focuses primarily on the U.S. market, which accounts for nearly 90% of sales.

Core Markets:

Without going into immense detail for the sake of time, I want to touch on each of AKS's core markets briefly, for a better understanding of its business.

Automotive Markets:

AKS addresses the major automotive manufacturers and their suppliers, with one of the company's largest clients being Ford Motor Company, accounting for 12% of AKS's sales in 2016 and 2017. FCA, the affiliate of Fiat Chrysler Automobiles, accounted for 11% of sales in 2016. Clients like these need only the very best of steels, regarding strength and customer service. AKS prides itself on collaborating with its clients to create the best solution for their needs. Also, in this collaboration effort, AKS and its clients work together to create new breakthrough products and innovations.

AKS has claims to have access to technologies that some of its competitors do not, such as AHSS, or advanced high strength steels and stainless chrome items. Many of the products that AKS sells to the automotive market have higher price tags than others, as they must be made precisely to the customer's specifications, and they must be made with incredible durability and under ever stricter government regulations.

Infrastructure & Manufacturing Markets:

This segment markets primarily to power transmission manufacturers, who produce equipment for the electrical grids spanning the country. It also serves heating, ventilation, and air conditioning equipment manufacturers. Infrastructure spending and construction activity have a direct effect on AKS's sales to the market.

Heightened efficiency standards for the market were in recent years implemented, which boosted demand for GOES, or grain-oriented electrical steel. The increased demand for electric vehicles is also expected to boost demand in the longer term. However, in AKS's 2017 annual report, the company noted that foreign GOES products have gotten cheaper, and so the domestic market has been flooded out by these cheaper alternatives, despite the recent tariffs.

Distributors & Converters Markets:

AKS has been slowly moving out of this market, as its pricing is unpredictable and oftentimes unprofitable. The segment serves steel distributors and converters, who typically buy from the spot markets, where pricing is quite often volatile.

Research & Development:

As one of AKS's main focuses, R&D and innovation is central to the company's path forward and future growth. The R&D efforts at AKS have recently been fortified with a new center for such efforts built in Ohio, housing the company's best researchers and engineers. In 2016, the company's efforts were awarded by Fiat Chrysler with the "Raw Material Supplier of the Year," in 2017. Even more recently, AKS has been awarded with $1.2 million from the U.S. Department of Energy (DOE) to "investigate novel low-density steels in the laboratory, which could ultimately be used in automotive structural applications," according to a news release on the company's website. The project will take place over three years with several partners for collaboration, with an end goal of testing and developing low density steels that will produce further efficiencies in automotive structural applications. Thus, the findings could greatly benefit the automotive unit of AKS, while potentially giving it a further competitive advantage.

Corporate Growth Strategy:

AKS has laid out a compelling story for potential growth in the future and has already made meaningful progress. Perhaps the most compelling growth initiative is a push into downstream businesses and new markets, with a recent acquisition of Precision Partners, a company that deals with tool design and hot/cold stamping. AKS is also planning on continuing its investment in its tubing operations, which is set to experience a record year in 2018.

Furthermore, AKS has strengthened its capital structure by refinancing debt to decrease interest expense and has lowered the cost of its revolving credit facility. Along with launching new coated steel products, the company has made major investments in some of their steel plants, installing new tanks at Middletown Works and upgrades for the melt shop at the Mansfield unit. In addition, AKS is currently, and plans to continue, improving its competitive cost position, to be able to better compete with cheap imports while promoting its high quality and innovative products.

Valuation and Outlook:

2018:

AKS's growth strategies and general macroeconomic conditions have improved profitability for the company, bringing it out of several years of net losses. Its prospects look better, although huge risks remain regarding the Trump Administration's success with negotiations with China over trade disagreements.

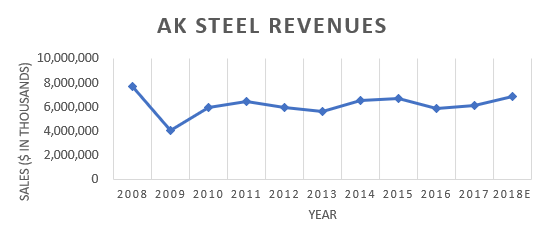

Since the great recession in the past decade, AKS has experienced low/negative revenue growth on an annual basis, and revenues are still lower than in 2008. The company has dealt with several issues, including weak product pricing, pressured margins due to higher costs, and large interest payments on debt.

AKS's Debt/EBITDA ratio is higher than most of its peers, at around 4.5x-5x recently, while the rest of its peer group is around 3x-4x. With the company's plans to bring that multiple down to 4x in the future, investors should expect to see slightly less spending on various CAPEX and other investments. And with an interest coverage ratio of nearly 1x, it leaves much to be desired, with a 2x ratio typically acceptable.

Despite several analysts forecasting Q4 2018 revenues higher, to just over $1.7 billion, I did not feel entirely comfortable with those forecasts, as Q4 is typically weaker, and the company has noted several headwinds, despite also noting continued strength in the market. My forecast stands at just below $1.7 billion, citing what the company expects to be selling price decreases, by 2%-3%, near zero growth in shipments, costly maintenance outages, and seasonal declines in the auto market.

For the full year of 2018, I am forecasting revenues of $6.84 billion, a 12% increase over 2017. Operating margins are set to expand, although mildly, to 5%, despite infrequent expenses such as facility idling. The company has published guidance for EBITDA margins to decrease by around 150 basis points in Q4, and I do not see that carrying through to the full year, with EBITDA margins rising to just under 8%, from the previous year's 6.44%. The company still has significant amounts of tax credits from its past losses available, and so investors can expect to see some of that being used up this year. I have an estimated range for EPS from $0.55 - $0.60. Interest expense is expected to decline only slightly on refinanced debt this year.

Other metrics are set to look brighter under my estimates, as well. With the aforementioned metrics, we should expect to see interest coverage rise to 2.25 on the year, along with cash coverage (EBITDA/Interest). Assuming AKS continues to decrease its debt exposure in the future, these metrics might continue to fall to even more reasonable levels.

2019 & Beyond:

I disagree with many other analysts' forecasts for earnings in 2019 and 2020, which seem to imply that strong economic conditions will prevail. As those forecasts are agreeable for a bull case, they are certainly not my base case. I expect automobile sales and housing to both take a hit in 2019, as economic growth is widely expected to slow. A sudden, sharp slowdown is possible. As AKS is sensitive to broad economic conditions, a sudden deterioration could hit the company, although pricing agreements set in advance will delay the hit.

Steel prices are expected to decline into the first half of 2019, although not dramatically, according to IHS Markit. The firm cites lesser chances of supply disruptions, since tariffs have been placed on the EU, rather than quotas. Prices in the U.S. are currently around 50%-80% higher than in Europe and Asia, and so those cheap imports will likely be a drag on the domestic market for steel.

Now on to 2019 estimates for sales; I still expect sales growth of nearly 3%, as management's guidance was upbeat on contracts and fixed pricing. The company has forecast research and development spending increases in 2019, which might impact profitability. Considering the broad economic conditions, expenses overall are likely to trend higher, pressuring margins. EBITDA margins in 2019 could be depressed by 150 basis points.

For my base case, I see EPS broadly in line with that of 2018, with limited upside, and more possibility of falling, although only slightly. That said, I have an estimated range of EPS from $0.47 - $0.60 for 2019. I am hesitant to narrow that range too much, considering the economic uncertainties and lack of clarity on fixed pricing contracts.

Multiples Valuation:

Applying the industry median EV/EBITDA and P/E multiples will yield a price target of $6.00 and $5.90, respectively, implying over 100% upside, given reversion to the industry median. Investor sentiment is not very kind to this stock and its respective industry, so a reversion of this sort and magnitude is not very likely, unless the steel industry benefits greatly from some sort of trade deal or economic improvement.

DCF Valuation:

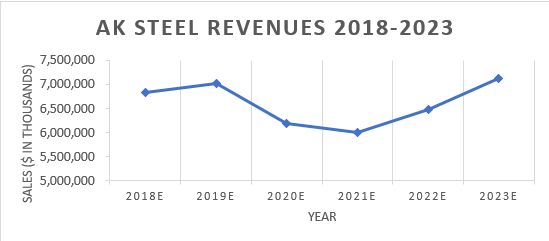

In addition, I conducted a thorough Discounted Cash Flows analysis over a period through the year of 2023. I forecast revenues with low - mid single digit growth, while forecasting an economic downturn in 2020-2021, in which revenues decrease by about 10%. This estimate might be too generous, given revenues slid by over 40% during the financial crisis. Revenues then recover considerably following the contraction, like that of 2010 and 2011.

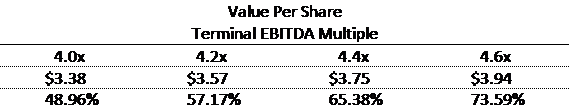

By holding WACC at a constant 14.8% and applying a 4.4x multiple to the terminal year, 2023, we are still seeing solid upside potential, with a target price of around $3.75. However, given the uncertainties surrounding the company and industry, I feel it appropriate to consider a multiple range of 4x to 4.6x, which yields a price target range of $3.38 to $3.94, implying still significant upside from recent trading levels around $2.25. Perhaps the stock has been beaten unnecessarily hard in recent years and deserves some more recognition.

Although estimated intrinsic value is much higher than recent trading levels, that does not mean investors will realize that and start bidding the price higher. Sentiment around the stock is still largely negative, albeit with potential for revival if a trade agreement is seen as beneficial for the industry. And with expectations for a volatile 2019 for the stock market anyway, sentiment is not very likely to improve drastically.

With all this noise and uncertainty under consideration, I cannot wholeheartedly put a hard "buy" or "sell" on AK Steel. Until further clarification on trade conditions and the economic outlook it is hard to say whether AK Steel will continue to thrive.

However, I do believe investors can

appreciate the initiatives the company has taken in recent years to drive

growth, and the road map to future growth organically, along with future acquisitions

and pushes into downstream segments and new products. The company's innovation drive

has driven growth already, and is very likely to continue to do so, especially

with the recent acquisition of Precision Partners. So, in the mid - long term,

AK Steel might be a stock worth watching, but in the short - midterm, investors

should steer clear from it, although keeping an eye on its growth prospects,

along with broader economic and trade specific conditions and developments.